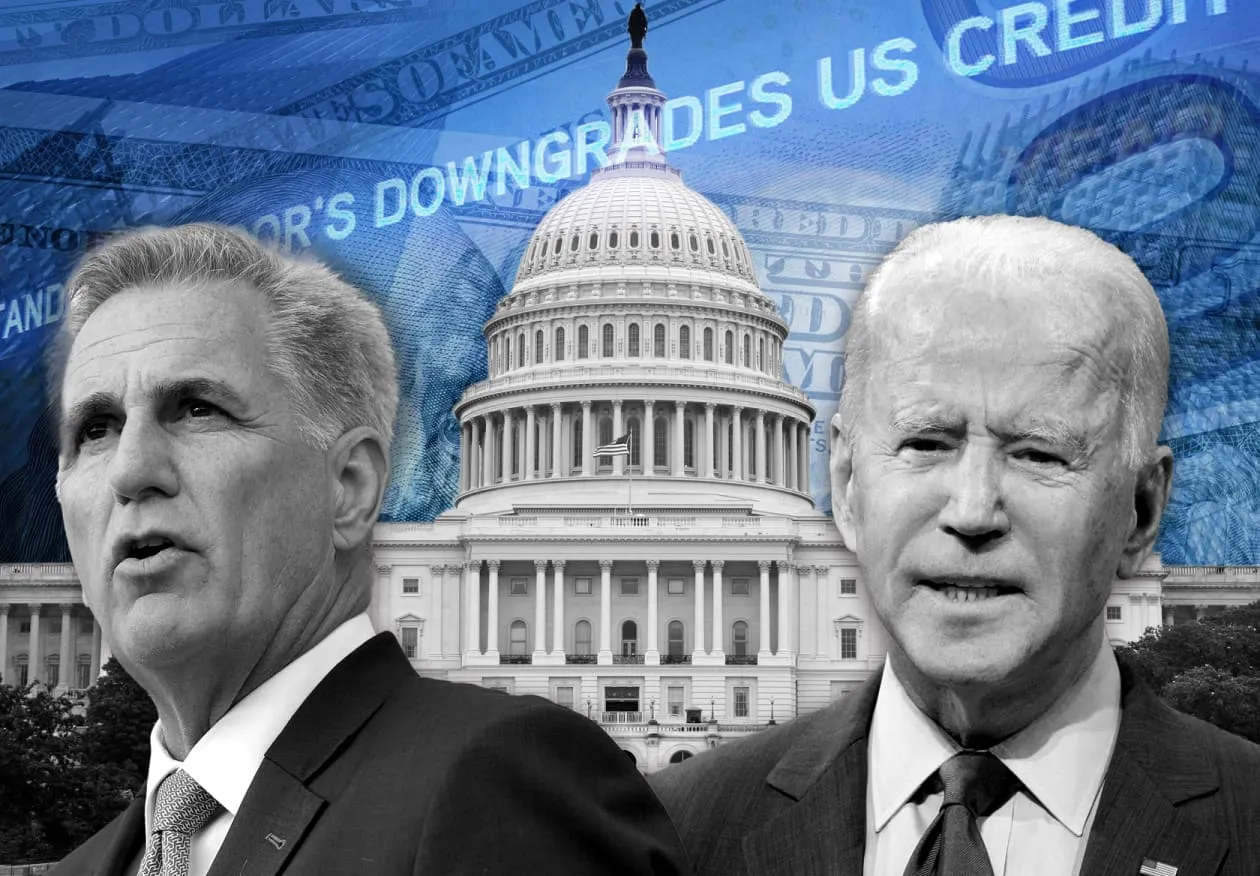

The American debt debate has returned to center stage. As U.S. Lawmakers from both parties are raising the alarm as the national debt surpasses $36 trillion and Treasury bond yields reach multi-decade highs.With interest payments threatening to overtake defense spending and entitlements, the debate in Washington has shifted from whether to cut — to what, how much, and how fast.

The bond market has become a barometer of national anxiety. Rising yields signal not only investor concern about long-term U.S. fiscal sustainability, but also a deeper unease about political gridlock and future inflation. Markets have become jittery, and so too have households and businesses. The mounting fiscal stress is now forcing an urgent rethinking of spending priorities.

🏛️ A Tipping Point for Debt Policy

For years, U.S. policymakers have borrowed at historically low interest rates. Now, however, that era appears to be over. In 2025, yields on 10-year Treasury notes have surged past 5%, the highest since the early 2000s. Higher interest rates mean ballooning federal interest payments, currently on track to exceed $1.2 trillion annually — more than the U.S. spends on Medicare.

What’s changed? A combination of factors: persistent inflation, slower-than-expected economic growth, new defense obligations in Eastern Europe and the Pacific, and the lingering cost of pandemic-era spending. Layered atop that is political instability — from fiscal cliff showdowns to threats of government shutdowns — further shaking investor confidence in long-term U.S. fiscal management.

💸 Interest on the Debt: The Hidden Budget Buster

Interest on the national debt has quietly become one of the largest items in the federal budget. As borrowing costs rise, debt service payments are crowding out discretionary spending. There is a growing strain on infrastructure, scientific research, education, and foreign aid.

Even popular programs are not safe. Republicans have signaled they may target social spending and climate funding, while some Democrats suggest trimming defense budgets and corporate subsidies. Neither party has ruled out restructuring major entitlement programs like Social Security or Medicare — long viewed as politically untouchable.

“We’re entering a period where hard decisions will no longer be optional,” said one senior House Budget Committee staffer. “We’re either cutting or capping, or we’re spiraling.”

🔍 Political Gridlock Meets Economic Reality

While the debt ceiling has been suspended until 2026, debate over fiscal responsibility remains volatile. In the House, fiscal conservatives within the Republican Freedom Caucus are pushing for immediate cuts and a return to sequestration-style spending caps. Meanwhile, progressive Democrats argue austerity could tip the economy back into recession and hurt working families.

President Biden has proposed a “balanced path” that includes targeted spending cuts, wealth tax increases, and closing corporate loopholes. However, with a divided Congress, passage is uncertain.

At the same time, states and municipalities — heavily reliant on federal funding — are bracing for the fallout. Infrastructure projects, Medicaid expansions, and green energy grants could all be paused or scaled back if federal funds dry up.

📉 Markets React to Fiscal Jitters

The rise in U.S. bond yields is a double-edged sword. On one hand, it reflects global confidence that the U.S.The economy is robust enough to sustain higher rates of interest. On the other, it shows concern that U.S. debt could become unsustainable if political leaders do not act swiftly.

Credit rating agencies have begun to issue warnings. While the U.S. remains AAA-rated by most firms, analysts warn that prolonged inaction could lead to a downgrade — which would further increase borrowing costs.

Wall Street is watching closely. Banks and corporations that rely on bond markets are seeing borrowing costs spike. Venture capital and tech startups — once flush with cheap money — are tightening budgets. Even the housing market has cooled under pressure from higher mortgage rates, partly driven by the bond surge.

⚠️ Public Sentiment and Political Risk

Americans are starting to feel the pressure too. A recent poll shows 62% of voters believe the government is spending “too much,” while only 23% believe the debt is being “handled responsibly.” Inflation, higher credit card rates, and mortgage costs are adding to frustration — making fiscal discipline a growing political issue heading into the 2026 midterms.

Public support is mixed when it comes to solutions. While many want spending reduced, few support cuts to Medicare or Social Security. Tax increases on the wealthy and corporations remain popular in polling, but face stiff resistance in Congress.

“Nobody wants to cut the budget — they just want it cut somewhere else,” said political analyst Dana Wheeler. “That’s what makes this crisis so difficult to resolve.”

🔄 The Reform Debate: Entitlements, Taxes, and Beyond

The pressure is leading to serious conversations about long-term structural reform. Proposals include:

- Raising the retirement age for Social Security eligibility.

- Changing the cost-of-living formula to slow benefit growth.

- To stop offshore avoidance, a minimal corporation tax floor should be put in place.

- Revamping the capital gains tax to increase fairness.

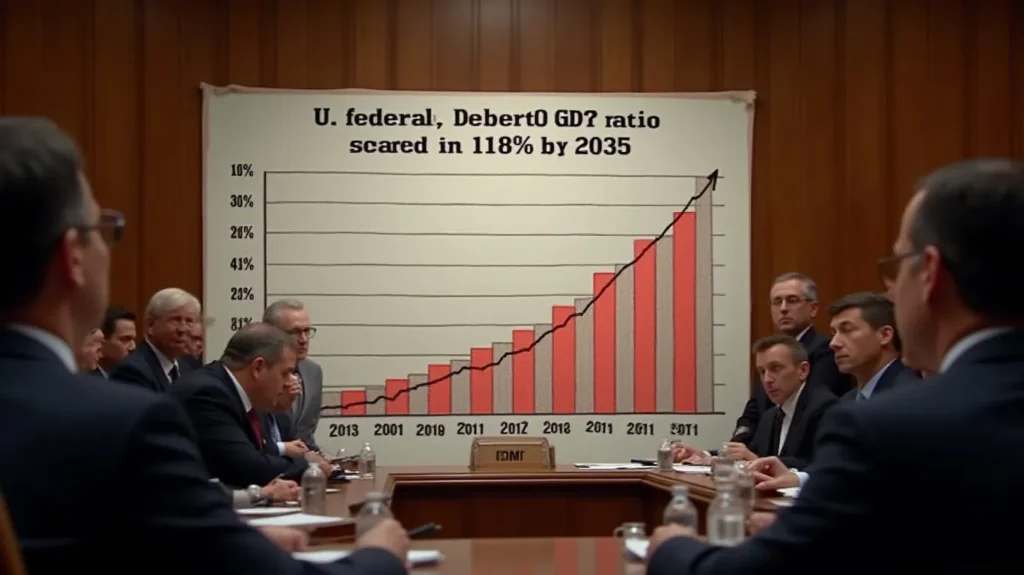

These ideas, while politically risky, are gaining traction behind closed doors. Economists argue that without major reform, U.S. debt could exceed 130% of GDP within the decade — pushing the nation into dangerous territory typically associated with fiscal crisis.

🌍 Global Implications

The world is watching. As the U.S. confronts its own fiscal stress, its ability to finance global military commitments, foreign aid, and international diplomacy could weaken. Allies are concerned that American indecision at home may embolden rivals abroad — particularly China and Russia, both of which are expanding influence through trade, military power, and infrastructure investments.

📘 FAQs: U.S. Debt Crisis and Bond Market in 2025

1. Why are U.S. Treasury bond yields rising?

Yields are rising due to investor concerns about inflation, growing federal deficits, and doubts over long-term U.S. debt sustainability. As risk rises, investors demand higher returns to buy government bonds.

2. How does rising national debt affect everyday Americans?

It leads to higher interest rates on mortgages, student loans, and credit cards. It can also limit funding for public programs and contribute to inflation or tax increases.

3. What does it mean that interest payments are outpacing defense spending?

It means the U.S. is spending more just to service its debt than it does on the military — a major shift that could constrain future budget flexibility.

4. Is the U.S. at risk of default?

No, the U.S. is not currently at risk of default, especially with the debt ceiling suspended until 2026. However, if political dysfunction continues, long-term risks increase.

5. What are lawmakers proposing to reduce the debt?

Proposals include cuts to discretionary spending, reforms to Social Security and Medicare, and tax increases on high earners and corporations.